Last week we were invited to an exclusive interview with the CEO of one the most prestigious brands in finance, a global pioneer in payment innovation and technology. Fortune magazine named him one of the most influential global leaders. He took over as CEO in July 2010, during one of the most difficult times of the company’s history, as the recession curbed credit card spending and new regulations cut into profitability.

Since then, the firm has achieved year on year 30% compound growth with a market cap of $26.5b in 2010 accelerating to almost $320b in 2020 and a 1500% return on stocks. At the same time, this CEO has shown the corporate world that you can do well by doing good. It’s a strategy that he lives by. One example is stock ownership. Currently, 70% of the employees own stock up from 25% – 30% in 2010.

While most people think of this firm as a credit card company, it really is a fintech innovator!

Can you share your vision for the company and its role as a leading fintech innovator, and what impact has Covid had on innovation?

“As a Leader I believe that in life 50% depends on being at the right place at the right time. When I took over in 2010 the company with its assets and capabilities was in the right place to move in a space beyond payments.

While the company still uses the payment transaction (be it a debit card, credit card, commercial payment or a prepaid card) as a source of what we do, we actually don’t make money only from transactions.

New revenue comes from Analytics, AI, Cybersecurity, Loyalty and Rewards, that have become ancillary services to the main payment that wraps around or envelopes the transaction. The transformation of the company derived from taking what I call ‘the rails’ that we built and building services around those rails, using the flow of data in the rails to generate insights and capabilities for all their clients, including banks, merchants, governments, corporates and fintechs.

During COVID our company delivers social benefits for governments to citizens – individuals and businesses.

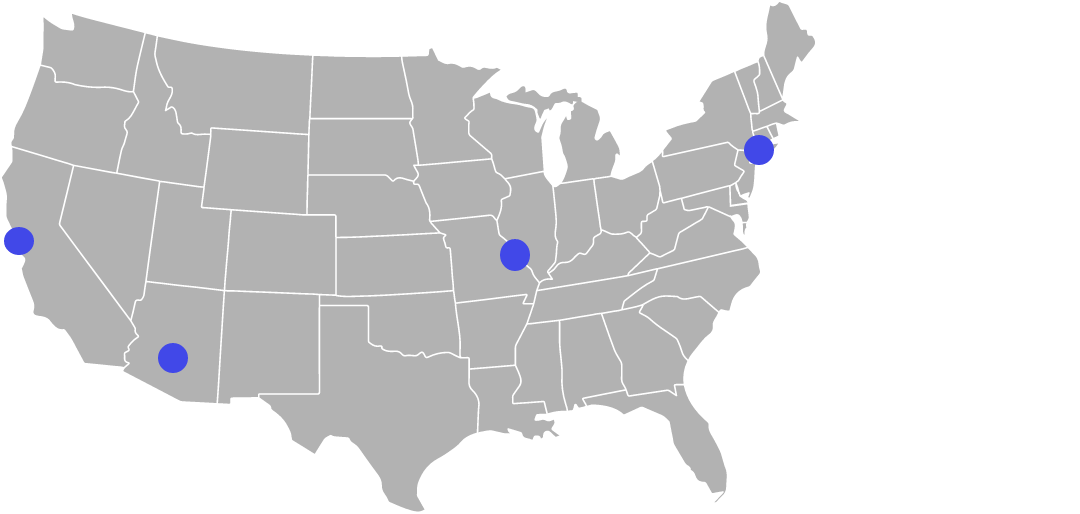

We are not a credit card company. In fact, we don’t even issue credit cards. Accounts are issued by banks or other authorized non-bank issuers, so Citi for example is one of our biggest issuers globally. Our company provides the infrastructure that manages 99% of UK payments and bank account transactions and that now operates in the US, Saudi Arabia, Singapore, the Nordics, Peru, Indonesiam and Thailand.

I care about seeing the transaction, we are not seeing the user data. We don’t see the customer’s name and don’t know anything about the transaction other than the 16 digit card number, the $ value, the transaction date and the merchant code. We don’t even know what the customer bought. The banks have that information but we only receive anonymous data and we are using this data to build new revenue streams.

With that data we are getting insights and building services around loyalty, cybersecurity, rewards and that business is now making 27% of our revenue and we want to build on this through partnerships with banks, governments and businesses.”

What is your company doing to include unbanked consumers and SMEs to get them into the financial ecosystem and to allow them to get credit?

“Early on the company redefined our competition, steering away from other network players, such as the other three leading card payment firms and locals. We defined alternative payment forms, mainly cash or check payments, as our competition.

Ten years ago, 85% of the world’s retail sales were in cash and 2b of the then 6.5b people on the planet had no identity or account. We wanted to offer a more efficient way to clear those cash transactions. When individuals or businesses operate with no identity and no account or card, it’s often with the purpose of tax evasion, which should be addressed and the issue for micro SMEs is that they can’t build up credit or get access to insurance.

For businesses, the problem is with micro SMEs – small family run shops with no payment account, no insurance, no credit score, no infrastructure. We decided to support those and governments to provide cash payments to their beneficiaries (pensions, salaries, health benefits, unemployment benefits, etc.) We needed to create an electronic form and then digitize the transaction to build credit scores. We have done this systematically.

I made a wild commitment in 2013/14 at a World Bank Forum when people asked what my ambition was for growth. I mentioned that I wanted to get to a market capitalization of $500m by 2020 which we achieved and we are on the way to double this to $1t by 2025. We also added 50m micro SMEs to our roster of clients over that period of time and are scaling this proposition across consumers and businesses.

The first step is to give them an identity and I’m a believer in freedom and therefore we, as a private company, should not know about the citizen’s data. It’s wrong.

We want the government to do the social contract and then tap into this via the cloud. From there the account can be accessed with iris identification, phone or fingerprinting. By the way, 42% of the money that comes from governments doesn’t get to its beneficiaries because of sticky fingers in the middle.

Our company supports micro SMEs in Africa to digitize the supply chain and utilizes AI to process credit transactions for farmers in Africa with RaboBank. We digitize the transaction to buy and sell fertilizer and crops to get them into the system to get access to insurance as well as credit. The trick is to get them into the digital space. Once you get them in, it changes everything.”

What do you think about cybersecurity and the dimensionality of the problem with COVID accelerating digital now?

“Cybersecurity is the single biggest challenge to exploit all the advantages of the internet. The internet is the ultimate transformative tool to democratise access. Think about what Google did to education! It created arbitrage but the Internet was not created for security and that is why cybersecurity is now problem # 1, 2 and 3.

Cybersecurity will have a big impact and so will data and 5G. As we all know, certain big businesses have exploited user data in unauthorized ways and we require the support from the government to address this as we recommended when I was part of Obama’s CyberCommission. We should create the equivalent of nutrition labels that food businesses have or an ABC rating like for Restaurants. It allows you to make a decision, when you buy a TV or computer for example, the label will tell you how safe the device is with regards to cybersecurity. Then we have to get rid of passwords. It is the least secure way to keep us safe. 70% of adult Americans have not changed their online banking password since they opened their account, which is often more than 10 years ago. We have a real problem with security and data privacy. Therefore we invest into Biometrics, AI and crypto, which we see as consumer orientated security with global standards.

We don’t want to go too far with organized data to hinder the great advantages of the internet, such as education or travel but if we are too open and too free it will cause privacy issues. We need an intelligent discourse and the right way to move forward.

Most of us have been hacked but not everyone noticed it. The dangers are the large criminal rings and corrupt governments. We owe it to our next generation to get it right. Our work and healthcare depend on it and we have to get it right.”

Why do you make diversity such a focus at your company?

“When I moved here in 2000, the US was very welcoming. No one cares about how you look and I don’t think that many other countries offer this. It’s the power and magic of the US. Diversity is still work in progress and the US government still doesn’t give proper maternity leave which is disgusting and crazy. There is still discrimination. My company relies on diversity for innovation, survival and growth. It’s the power of America that we are surrounded by different people. People who are the same, also have the same blind spots. Blind spots are hindering survival. Diversity is good for you and everyone else. We should demand it and we should want it. Andy Grove from Intel used to promote Management by contention and suggested that no good idea is worsened by questions. Ideas are refined by questions. I have a sign in my office which says “Question Everything, Always!”. It’s about the diversity of perspective.”

What do you do as a Leader to manage through this crisis of the pandemic?

“We are living in amazingly difficult times and in early March it felt like the world was going down. It’s better now but far too early to celebrate. There are still health and economic challenges. The problem now is the growing gap between emerging and developing markets. We have lost years of progress to close that gap and that exacerbates inequality and the issue between emerging and developing countries. I am deeply concerned that we are going back years now.

As a company leader I need to keep my people safe and healthy and then deliver for our clients, so we went remote and our technology allows us to do so.

We have a headwind on consumer spending and commercial spending and a tailwind on AI, Data and cybersecurity. The more you communicate the better it works for you and your teams but if you are young it might be different. If you live in an apartment in Manhattan with a spouse, a mother and a dog, it might be difficult to communicate and it can affect your physical and mental health. We have to find a way to address mental health as well. We have therefore signed up with Adriana Huffington to help our people with mental stress. We created an accelerator with the Wellcome Trust, the Gates Foundation, Madonna, the UK government, Michale Dell. We reached $400m and are making progress on drugs and vaccines.

We put $250m into small business digital payment access, how to open a website, cybersecurity. We gave hospitals free cybersecurity. Doing well by doing good. This is our way through COVID.

How long will employers like to work remotely? Innovation, creativity and culture cannot continue only through zoom calls. Trying to get back with social distance. Get employees more flexible in their work methodologies.”

Tell us about your definition of DQ?

“When you are young they tell you IQ is most important, then later on EQ is more important but I have coined DQ.

When I was younger it was all about passing IQ tests. But this Idea is about the ability to sort through difficult times, almost like managing adversity, to be able to pour oil on troubled water. DQ is Decency Quotient. People want to work for decent people. You bring your heart and mind to work and act transparent, frank and fair. I don’t mean nice. If someone doesn’t do a good job you don’t give them credit for it. That would be wimping out on a difficult moment.

If you are a leader it’s a privilege. People look for guidance, a fair level playing field and help when they make a mistake. Decency means you recognize that you are in a privileged position as a leader and you bring your heart and mind to work and help people. Everyone makes mistakes. It’s about the ability to learn from them and how you respond to them.”

What is your company’s play in cryptocurrency?

“My view is that the underlying technology of blockchain has enormous promise. The first use was cryptocurrency but bitcoin exhibited challenges, like volatility and anonymity.

Bitcoin was an asset not a currency. I step away from bitcoin, I call it junk.

I love blockchain technology because it democratizes access. It takes away the anonymity and instability that bitcoin has. So we have found some business cases that we continue investing in, for example proof of product, such as:

“Is that organic shrimp actually organic and off the coast of New Orleans”?

“Is that shirt that you are wearing actually from Egyptian cotton”?

“Is that recalled milk powder that you bought for your baby from a specific farm using a specific truck route and therefore that truck route is affected and therefore those products need to be pulled back, etc.?”

“Is that diamond a blood diamond and not mined in an inappropriate way?”

“Is that art genuine and has all the right certification and isn’t theft”?

Those proof of provenance examples we have launched in a number of countries.

The question will be what role does the central banks play in all this and what role the commercial banks? There is a lot of sorting out to be done in a number of different areas.”

How is your company helping India to reach the poorest with direct benefits?

“India has made enormous strides on opening a bank account for people without a digital identity. They created an identity system and gave everyone a unique identity with their biometrics. The idea is fabulous and has been executed very well, the person that designed it is a brilliant entrepreneur. The challenge is digital identity technology has moved on. And one of the ideas today is to distribute the identities rather than holding it in one place. The new digital identity measures keep the data in different places and you only get the piece of information that you need and you protect it in a cryptowall and that is a distributed digital identity.

We helped farmers with a Farmers Network to connect them to smart phones and get access to cooperatives where they are able to get cheaper fertilizers and such and sell their produce into the cooperatives and they don’t physically sell it and have to come back with cash in their pocket and deposit into a bank account. Making it more efficient for the farmers and also having access to insurance is important.

For micro SMEs, if you are a young woman in a village and you have your shop in your home and have no access to credit. The trucks that come with supplies from vendors once a week. If you can digitize the transactions, you can get these SMEs access to credit in the form of loans and get them underwritten. This is something that we are doing all over Africa and we are trying to bring this to some states in India.

For small businesses, we help them take their business online and help with their website but also digital payments to get them going as in this day and age without digital your business is not capable of survival.”

What do you think are the most interesting sectors for growth within the next 2- 5 years coming out of this COVID crisis?

“Going beyond FinTech, with 5G there is this whole new world coming where every device is enabled and to be a location that generates and receives data to make informed decisions. Sensors in every piece and they can speak to each other, there will be enormous opportunities in the sensor space and data management space and AI, cybersecurity and of course FinTech and payments space because of all the data.”

Can New Account Management (Apple Pay, etc.) replace Credit Cards?

“I care about being part of the management of the account, I don’t care about the credit card. For example, Apple Pay can’t manage without access to someone’s account, which may be linked to a Credit Card or Debit Card or a Bank Account and the same for Paypal. You have to fund the wallet in some way. I am in that business, the account access business. I am different from my competitors who are not in the bank account connectivity business, they tend to be in the card business. We are in the multirail business. I am agnostic as to which payment instrument you access your account with, I want to be there in the account access business and make it safe, smart and simple.”

Looking forward to the next 5- 10 years which are the next 2-3 innovations which will have a big impact on the financial world?

“Blockchain in so many different ways, not Bitcoin. The idea of what the blockchain does through a publicly distributed ledger to come up with the digital identity. The old days of keeping everything in one place, that’s a bad place to be. You need to think about the distributed system that by the nature of the beast it adds complexity to break it.

Secondly, the 5G revolution. Every device should be a device of performance, machine-to-machine transactions of small sizes will pick up a large part of what we do. For example, when you drive your car to the gas station, you will want to pay for your gas, but also pick up a Coke and go through the car wash and pay for all by the systems that recognize that this is you and it’s your car and you are authorized to use it for all these purposes and you want to pay from XYZ location and pay seamlessly either through your heartbeat or irises or by waving your hand or just by being there. The idea of blockchain combined with 5G and what it does with distributed devices, I think those two are going to transform everything.

What can hold this up is cybersecurity and data privacy. It can turn back the clock on the opportunity of the next decade. The data privacy issue is already happening with all the controversy we have around certain companies and their access to your information. As a result, one or two mistakes will cause trouble for everyone. A knee-jerk reaction to stop everything or to organize data country by country would be a disaster. India, for example, wants to keep all data inside but if you do that you don’t allow that data to be merged with data around the world you will lose because you will not be able to see patterns or cyber developments. You won’t be able to get access to true medical advancement and at that point you will want access to data but don’t want to give access to yours. In the global interconnected world this is not good. We need to be thoughtful, we need to protect our citizens, their privacy but we should not put up barriers.”