Case Study: InRhythm Pods

Redefining Credit Card Payments

The Client

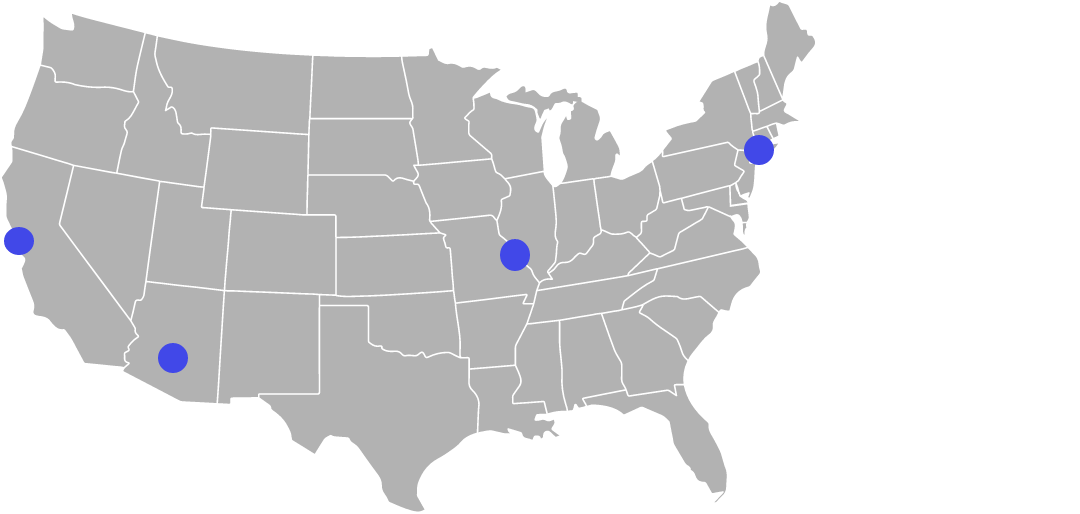

Our client is a global leader in credit card services. They are a multinational firm that processes payments for millions of merchants plus hundreds of banks and credit unions.

The Opportunity

Insights gained from our client’s customer base revealed that digital payment platforms were out-competing credit card payments with respect to convenience and cost-effectiveness. Our client, along with its competitors, were being asked by their mutual customers to standardize credit card payments for a secure, seamless, and consistent credit card experience across web and mobile. Additionally, the collective request of the merchants was to reduce the transaction fees which would be feasible — if the payment process could be simplified. The opportunity presented was the development of a new platform and standard for credit card payments that would offer a seamless experience across all devices; a more consistent experience would translate to more transactions.

The InRhythm Impact

InRhythm created a high-performing team of 36 engineers consisting of Frontend, Backend, DevOps, and SDETs to meet the opportunity. Numerous challenges faced the team including standardizing three, competing credit card networks on a single process where each had its own complex transaction processing schema. This was the essential first step on the path to developing a unified user interface with a navigation experience that would be seamless regardless of which IoT device the payment was transacted on.

Our InRhythm pods crafted a microservices-driven architecture for extensibility and scalability. The teams created iterative API frameworks for enhanced control over the services with increased accessibility and ease regarding future modifications that would be needed to meet the evolving needs of their clients. Centralized and standardized testing complemented by defined deployment procedures were developed to streamline DevOps and QA efforts.

The Secure Remote Currency (SRC) platform allows consumers a password-free digital checkout with advanced technology and security. The InRhythm team utilized such tools and methodologies as HTML, CSS, Javascript, VueJS, Jest (Unit Testing Framework), Cypress.io (integration end to end testing), PactJS (FE & BE Contract Testing), SpringBoot, Redis, MIcroservices, 12 Factor Apps, Oracle, PCF, CI/CD, Jenkins, gUnit, WireMock.

The resulting new platform offers consumers a password-free digital checkout with augmented technology and enhanced security. Upon rolling out the new platform that we developed, our client immediately noticed an uptick in the number of daily transactions, a reduction in fraud and increased consumer satisfaction. Hassle-free checkouts with increased consumer confidence has resulted in higher volumes of credit card transactions and reduced fees for merchants.